Below we share in details the highlights of the Malaysian housing index

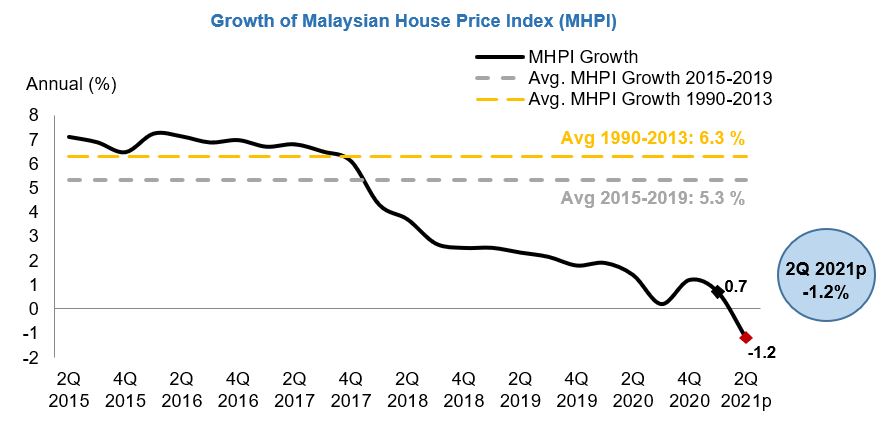

Malaysian House Price Index (MHPI):

- In 2Q 2021, growth of the preliminary Malaysian House Price Index (MHPI) dipped into the negative territory, recording a small contraction of 1.2% (1Q 2021: 0.7%).

- In the first half of 2021, MHPI growth moderated to -0.3% (2H 2020: 0.7%; 1H 2020: 1.7%).

- This was driven by the decline in prices across all types of properties during the quarter, except for terraced house, which recorded a small positive growth of 0.9%.

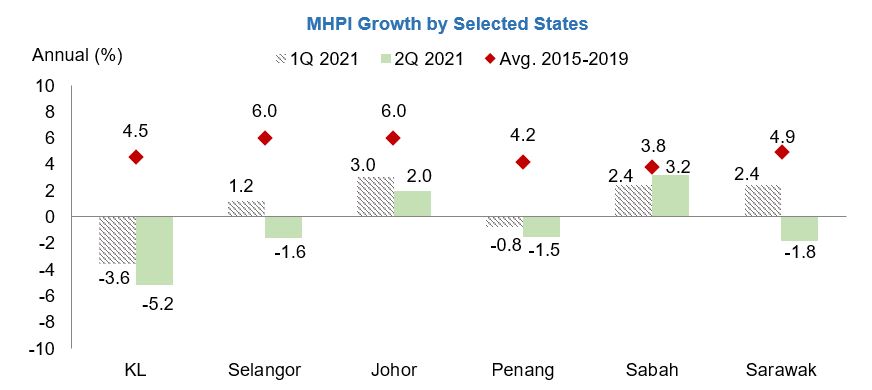

- By state, the annual decline in MHPI was observed across major states, in particular Kuala Lumpur (-5.2%), Selangor (-1.6%) and Penang (-1.5%).

Note:

- Based on historical trends, the final MHPI estimates may be revised upwards to reflect additional data submissions for the quarter.